All categories

1 / 20

Description

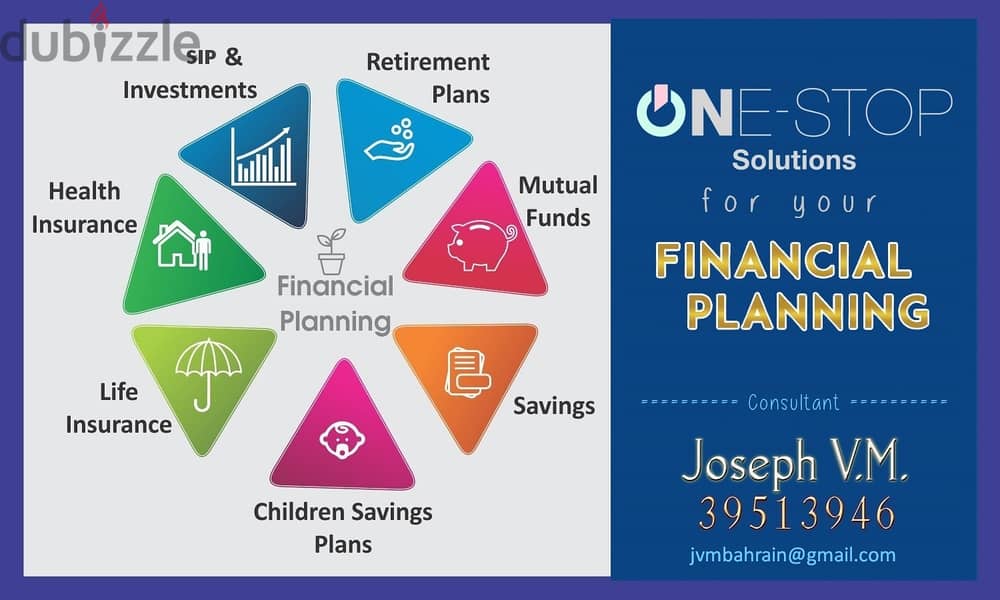

Financial planning helps you determine your short and long-term financial goals and create a balanced plan to meet those goals.

Life insurance is a key financial planning tool that can often be overlooked. However, life insurance can help build an estate for those who die prematurely prior to accumulating sufficient assets on their own and can also be an integral part of your overall financial planning efforts.

Mutual funds pool money from multiple investors to build diversified portfolios of stocks, bonds and other securities managed by finance professionals.

Fund shares are priced once daily at market close based on the net asset value (NAV) of all holdings minus expenses divided by total shares.

Investors can earn returns through capital gains when fund holdings increase in value, dividend and interest distributions, or selling shares for a profit.

And an important aspect of financial planning for emergencies is getting health insurance coverage. If you face any medical emergency, medical insurance policy can help be financially ready to meet the expenses without derailing your financial plan.

Location

Bahrain

Ad id 105412031

Report this ad

Listed by private user

PROPOSALS

Member since Aug 2022

See profile

Your safety matters to us!

- Only meet in public / crowded places.

- Never go alone to meet a buyer / seller, always take someone with you.

- Check and inspect the product properly before purchasing it.

- Never pay anything in advance or transfer money before inspecting the product.